Can Your “Salary Saving Scheme” Really Give You Peace of Mind in Retirement?

Let's be honest. The phrase "salary saving scheme" might sound like another dry, corporate financial term. You might picture a complicated spreadsheet or a restrictive budget that makes you give up your daily coffee.

But what if we told you that a salary saving scheme is the exact opposite? It’s not about restriction; it’s about automation and strategy. It’s a pre-planned, systematic approach to moving money from your "Earn" account to your "Grow" and "Save" accounts before you even get a chance to spend it.

In short, it’s the most effective way to build wealth without the mental burden of willpower. Let's break down how it works.

How the "Salary Saving Scheme" works?

Step 1: The 50/30/20 Rule – The Foundation of Your "Salary Saving Scheme"

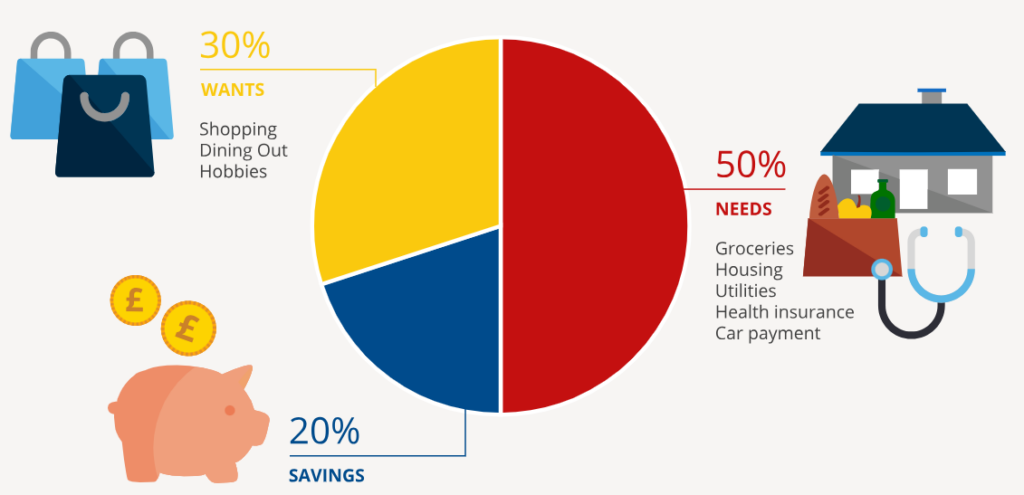

Before any automation can happen, you need a blueprint. The 50/30/20 rule is the most reliable framework for structuring your salary saving scheme. It's not a strict diet for your money, but a balanced guide to ensure your finances are healthy.

- 50% for Needs: This covers your essential, non-negotiable expenses. Think rent or mortgage, groceries, utilities, basic transportation, and minimum loan payments.

- 30% for Wants: This is for the things that make life enjoyable—dining out, hobbies, entertainment, travel, and that subscription service you can't live without.

- 20% for Savings: This is the most crucial category. This 20% is not for tomorrow; it's for your future self. It's the engine of your entire scheme.

Why this works: It creates immediate clarity. If you earn $4,000 a month after tax, you know that $800 is immediately earmarked for your future. This isn't leftover money; it's the first and most important bill you pay—to yourself.

Step 2: Build Your Automation Engine

Knowing you need to save 20% is one thing; actually doing it consistently is another. This is where the real "scheme" comes into play. The goal is to make saving effortless.

The moment your salary hits your account, automatic transfers should immediately divert that critical 20% to its designated destinations. This act of "paying yourself first" forces you to live comfortably on the remaining 80%, and you effectively "forget" the money you've already saved.

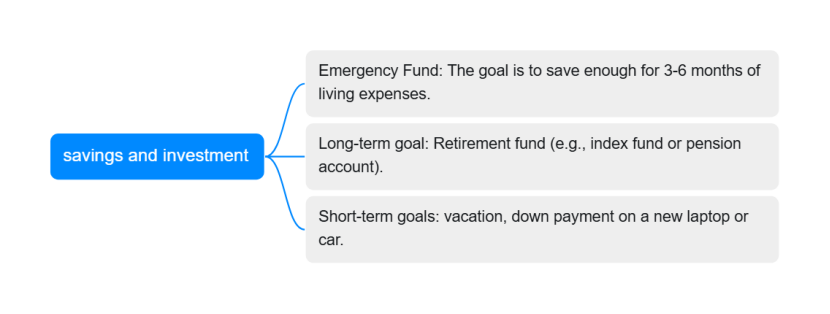

Here’s how to split that 20% for maximum impact:

- Priority #1: The Emergency Fund. Your financial safety net. The first goal is to build a cushion that covers 3-6 months of essential living expenses (that 50% from Needs). This fund stays in a liquid, high-yield savings account—it's not for investing, it's for peace of mind when life happens.

- Priority #2: Long-Term Growth. This is for your future retirement. Once your emergency fund is stable, focus this portion on long-term, tax-advantaged accounts like a 401(k) or an IRA. Consistently investing in low-cost index funds here harnesses the power of compound interest.

- Priority #3: Short-Term Goals. This chunk is for your tangible, near-future dreams. Saving for a vacation, a down payment on a car, or a new laptop? This fund makes it happen without derailing your other financial goals.

Proving It Works: the Data Behind the Scheme

This isn't just feel-good advice; it's backed by behavior and data.

The Power of Automation: A Vanguard study analyzed participant behavior and found that those who used automatic contribution increases were 40-50% more likely to achieve their target savings rate compared to those who relied on manual decisions. When saving is the default, you stick with it.

The 50/30/20 in Action: Let's take Sarah, a graphic designer with a $4,500 monthly post-tax salary. Using the 50/30/20 rule, she allocates $900 (20%) to savings. She automates $400 to her emergency fund, $350 to her retirement index fund, and $150 to her "new laptop" fund. In 10 months, she has a robust emergency fund, her retirement is growing, and she buys her laptop in cash—all without ever feeling like she was on a strict budget.

Common Salary Saving Pitfalls (And How to Avoid Them)

Pitfall #1: Setting an Unrealistic Amount. Starting by saving 30% of your salary is a recipe for failure. If 20% feels like a stretch, start with 8% or 10%. The key is consistency. You can always increase it by 1% every few months.

Pitfall #2: Forgetting to Adjust. Life changes. Get a raise? Immediately increase your automatic savings amount by half of the raise. This grows your wealth without shrinking your lifestyle. Review your allocations every 6 months.

Pitfall #3: Being Too Rigid. The 50/30/20 rule is a guide, not a prison. If you live in a high-cost area, your "Needs" might be 60%. Adjust the other categories accordingly—the core principle is to protect that savings percentage.

Final Verdict

A salary saving scheme is not a magic trick. It's a disciplined, automated system built on the proven 50/30/20 framework. By paying yourself first, you shift from being a reactive spender to a proactive builder of your future wealth. The best time to start was yesterday; the second-best time is today. Log into your bank portal and set up that first automatic transfer. Your future self will thank you for it.