Salary Calculator Texas: How to Estimate Your Take‑Home Pay in Texas

If you live or work in Texas and want to know what your real take‑home earnings are, a reliable salary calculator Texas is essential. This guide will walk you through how the salary calculator Texas works, what you need to input, and what to consider — so you can quickly estimate your net pay after taxes and deductions.

What is the salary calculator Texas?

The salary calculator Texas is an online tool that takes your gross pay (annual salary or hourly wage), your pay frequency (weekly, bi‑weekly, monthly, etc.), and optional info like deductions or overtime — then calculates your expected net (take‑home) pay after federal taxes, social security, medicare, and other relevant withholdings.

In other words, instead of guessing what you’ll get paid “on paper”, this calculator shows you what will actually land in your bank account. For many people accepting a job offer or comparing different offers, that makes salary calculator Texas far more useful than just looking at gross salary.

Why you need a calculator in Texas?

Using a salary calculator Texas helps you:

- Understand your net salary — what you’ll actually get paid after deductions.

- Budget realistically: rent, bills, savings, investments — based on real income rather than gross pay.

- Compare offers: two jobs might have similar gross pay, but after taxes and deductions, take‑home pay could differ significantly.

- Account for overtime, bonuses, and deductions (health insurance, retirement contributions, etc.) to see their impact on real income.

Especially in a state like Texas — more on that next — a salary calculator is practical and straightforward.

Process for filing taxes in Texas

Here’s typically what you do when using a salary calculator Texas:

- Enter Gross Income — annual salary, or hourly wage and hours worked if you’re hourly paid.

- Select Pay Frequency — weekly, bi‑weekly, semi‑monthly, or monthly.

- Add Optional Deductions or Benefits — pre-tax deductions (like health insurance, retirement plans), post-tax deductions, or extra income like overtime/bonuses.

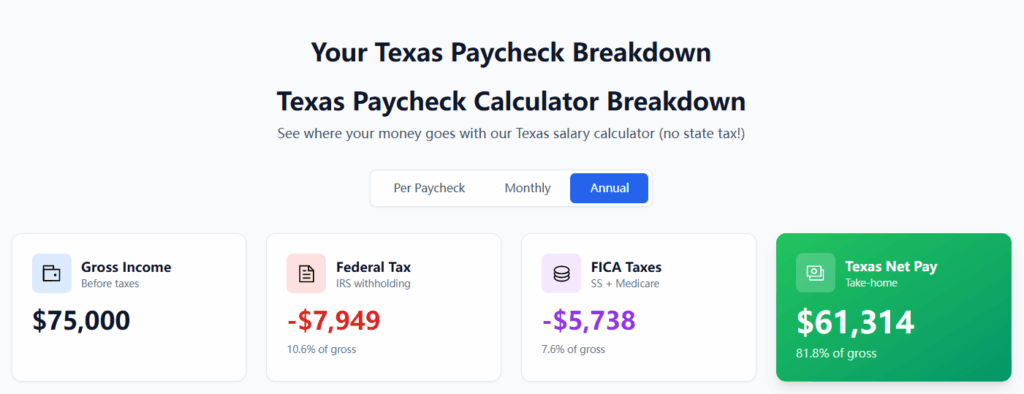

- Calculate with Applicable Federal Taxes and Payroll Taxes — since in Texas there is no state income tax, deductions include federal income tax, Social Security, and Medicare.

- Get Net Pay (Take‑Home Pay) — see a breakdown showing gross pay, taxes withheld, deductions, and actual take‑home salary.

Optionally, the calculator may let you simulate different scenarios: different pay frequencies, various overtime hours, additional deductions, etc., letting you project how each factor affects your take‑home pay.

For example, if you are single in Texas with an annual income of $75,000, the salary calculator Texas shows that your take-home pay would be $61,314.

What makes Texas different: no state income tax?

One of the key reasons a salary calculator Texas is especially useful — and simpler — is that the state of Texas does not impose a state income tax.

That means that for residents of Texas:

- Your paycheck deductions only include federal income tax + federal payroll taxes (Social Security, Medicare), plus any chosen benefits or deductions.

- You don’t have to worry about additional state-level withholdings or local taxes.

This simplifies planning and makes it easier to understand what you’ll actually take home — which is why using a Salary Calculator Texas gives a much clearer financial picture than just trusting gross salary alone.

How to choose the right Salary Calculator Texas?

Not all calculators are built the same. When selecting a salary calculator Texas, make sure it:

- Allows input of gross salary or hourly wage + hours — depending on your job type.

- Lets you set pay frequency (weekly, bi‑weekly, monthly, etc.) correctly.

- Includes standard federal deductions: income tax, Social Security, Medicare.

- Lets you add extra inputs: overtime, bonuses, pre-/post-tax deductions, benefits.

- Provides a breakdown: gross pay → deductions → net take‑home pay.

- Is up to date with current federal tax brackets, FICA rates, and standard deduction rules.

Some of the widely used calculators for Texas include those by payroll‑tool providers and finance websites supporting state‑specific rules.

Tips when using the salary calculator Texas for budgeting

- Always input correct pay frequency — monthly vs bi‑weekly will change net pay per check.

- If you expect overtime or bonuses, include them in the calculator to see their real impact.

- Account for pre-tax deductions (like health insurance, retirement), as they reduce taxable income and affect take‑home pay.

- Use the tool to compare different job offers — focusing on net pay helps you make realistic choices.

- Re-run the calculation when your personal situation changes (marriage, dependents, extra income, deductions) to get accurate paycheck estimates.

Common questions about salary calculator Texas

Q: Does salary calculator Texas include state tax?

A: No — since Texas does not impose state income tax, the calculator only deducts federal taxes and payroll taxes (social security, medicare).

Q: Can I use salary calculator Texas if I’m paid hourly?

A: Yes. Most good Texas calculators let you enter hourly wage + hours worked instead of annual salary.

Q: Does the calculator account for overtime, bonuses, or extra income?

A: A quality calculator should allow you to enter overtime hours or bonuses to see their effect on net pay.

Q: Can I estimate deductions like health insurance or retirement contributions?

A: Yes — many calculators let you input pre‑tax and post‑tax deductions so your net pay reflects realistic take‑home pay.

Q: Is the result exact?

A: No — these calculators provide an estimate. Actual net pay may vary depending on company benefits, withholding elections, or additional deductions.

Conclusion

If you live or work in Texas and want to know what you truly earn — not just what your gross salary says — using a salary calculator Texas is a smart move. By accounting for federal taxes, payroll taxes, deductions, pay frequency, overtime and more, it helps you estimate your real take‑home pay accurately. With no state income tax, Texas makes the calculation simpler — but using a reliable calculator remains essential for sound budgeting, smart job‑offer comparisons, and financial planning.